Customer Churn: A 101 Guide on Who Quits Your Product 💔🔍

Also, let's understand what NPS is and how World War II revealed key insights into survivorship bias.

Hello, curious minds and data enthusiasts!

Welcome to our 4th edition of DataPulse Weekly, where we unravel the magic behind data and its impact on our daily lives.

Each newsletter promises to be a journey through the fascinating intersections of data, technology, and human experiences. Whether you're an analyst, a tech enthusiast, or simply curious about how data shapes our world, you're in the right place. Let’s dive straight into today’s Data Menu -

Today’s Data Menu

Data Case Study: A 101 Guide on Who Quits Your Product

Metric of the Week: Net Promotor Score (NPS)

Visualization Spotlight: NPS of Leading Life Insurance Brands in India in 2023

Human Bias Focus: Survivorship Bias

Data Nuggets: Probability vs Possibility

Data Case Study:

Picture this, your company has built a great product after putting in significant efforts to achieve that perfect blend of innovation and utility. Your company made it public, and customers are flocking in. But then, the activity of the old user starts to drop. And everybody is asking what's happening.

When the activity of old user starts to dip, it serves as a prompt for businesses to scrutinize a key indicator of their health: the churn rate. This metric acts as an insightful proxy to gauge customer loyalty and the value your product delivers to them.

Churn occurs when customers stop using a company's services or products after a certain period of inactivity. The period of inactivity can be defined based on the nature of the industry or products. For example:

SaaS (Software as a Service): 30 days of inactivity post-subscription expiry without renewal.

Telecom Services: 60 days of inactivity.

Retail: No repeat purchase within 12 months after the last order.

In addressing this problem, today we will explore an industry with one of the highest churn rates: the Telecom industry. In the telecom sector, it's common for customers to switch from one operator to another due to the highly competitive nature of the industry. This results in an average annual churn rate of 23%. Given that it costs up to 10 times more to acquire a new customer than to retain an existing one, customer retention becomes a critical focus, even more so than customer acquisition.

Our goal for today's case study is to identify all the factors that could help us understand churn and to conclude with a sample graph based on exploratory data analysis (EDA). You might wonder, what is exploratory data analysis? It's a method of analyzing data sets to summarize their main characteristics, often utilizing graphs and other visualization techniques.

Now, let's explore the key data points that could potentially influence customer churn:

Customer Demographics and Technographics

Age: Indicates customer preferences, with younger users potentially favoring digital over traditional services.

Gender: Provides insights into diverse customer needs and preferences.

Location: Geographic insights can influence service usage patterns and network quality expectations. This can be further broken down by State, City, and Pincode.

Estimated Income: This may influence user sensitivity to usage costs.

Dependents: The number of dependents could affect plan choices and data usage needs.

Device Type and Operating System (OS): The device type and operating system may affect the service experience and satisfaction.

Customer Journey and Engagement

Postpaid vs. Prepaid: This macro-level customer segmentation significantly affects our churn analysis due to differing customer behaviors.

Service Start Date: The duration a customer has been with the company, indicating loyalty and reducing churn likelihood.

Plan Type: Factors like data limit and speed influence customer satisfaction; different plans appeal to various customer segments.

Usage Behavior: Metrics such as call duration, number of calls, data consumption, unanswered calls, roaming usage, etc. help identify highly engaged customers or those at risk of churn.

Billing Info:

Payment Methods: Ease of bill payment can impact customer satisfaction.

Billing Cycles: Frequency and regularity of payments can reflect customer satisfaction.

History of Late Payments: Frequent late payments may indicate dissatisfaction or financial distress.

Monthly Billing Amount: Changes in a customer's monthly billing amount can significantly affect satisfaction levels.

Total Amount Paid: Overall spending may correlate with customer loyalty or service perception.

Value Added Charges: Charges beyond regular usage may influence customer perception.

Network Quality Metrics

Call Connectivity: High dropped call rates can indicate network issues, affecting customer satisfaction.

Data Speeds: Slow speeds can frustrate customers, potentially leading to churn. This aspect can be analyzed based on the 2G, 3G, or 4G network types.

Customer Support Interactions

Support Metrics: The number of interactions, call wait time, average support call duration, and query resolution time are key service quality indicators.

First Call Resolution (FCR): Indicates if a query was resolved in the first call interaction.

Customer Feedback: Poor customer ratings can indicate unresolved issues.

Please share in the comments if we've missed any important variables that we should have considered.

We can summarize all these variables by aggregating the metrics mentioned above for the last 30 days. After creating these, we examine whether users have retained or churned after specific days of inactivity. A binary flag—Yes or No—is added to identify churned users. This preparation makes our data ready for analysis.

Once we have comprehensive data, we formulate some hypotheses and perform Exploratory Data Analysis (EDA). EDAs are effective in revealing what is happening across different segments. We will conclude this section with a key insight from the EDA:

The data shows that as the number of support queries increases, more users stop using the carrier and potentially switch to another carrier. Have you noticed any less obvious patterns here? A closer look reveals a significant spike in user churn when queries increase from 1 to 2, which aligns with the importance of the first call resolution metric. While companies can encounter issues or bugs, resolving users' problems on the first call greatly increases the likelihood of them remaining with the same company.

Key Takeaway:

Pinpointing which customers are departing is crucial for identifying and understanding the factors influencing their choices. The churn rate serves as a direct reflection of the value businesses provide to their users, with top-performing companies effectively maintaining optimal churn rates.

Firstly, it's vital to clarify what the churn rate means for your business within your specific industry context. Following this, delving into the various factors that contribute to customer churn is key, including identifying less obvious influences. Through exploratory data analysis (EDA), connections between churn rates and different factors begin to emerge, forming a comprehensive foundation for a strategy aimed at understanding and mitigating churn. Further analysis using advanced classification models such as Random Forest or XGBoost is instrumental in identifying crucial features and forecasting the potential for customer churn. A deeper examination of these models to uncover further insights is a journey we will undertake in future discussions.

Understanding the importance of loyalty sets the stage perfectly for our next focus: the Net Promoter Score (NPS), a crucial metric for measuring customer experience.

Metric of the Week: Net Promotor Score

What you've encountered is a prime example of a Net Promoter Score (NPS) question, a strategic metric businesses utilize to measure customer satisfaction and loyalty.

Recommending something is a clear sign you're satisfied with it, right? That’s where NPS comes in, a key metric in measuring customer experience. NPS gauges how loyal and satisfied customers are to a brand, with scores ranging from -100 to +100 — obviously, the higher, the better.

So, how do we figure out this score? NPS uses a simple method: it asks customers how likely they are to recommend a product or service on a scale of 0 to 10. Those who answer with a 9 or 10 are your "Promoters" - think of them as the cheerleaders. Then you've got the "Passives" (7 and 8) who are content but not shouting from the rooftops, followed by the "Detractors" (0 to 6), the ones who are less than impressed.

NPS can also be measured on a 5-point scale. Here the responses are grouped a bit differently. A score of 1 to 3 indicates Detractors, a 4 is considered Passive, and a 5 means Promoter.

Calculating NPS comes down to this formula: NPS = % Promoters - % Detractors. Passives count in the total response but don't sway the score either way.

In a nutshell, NPS represents the difference between the percentage of highly satisfied customers and those who have had poor experiences, offering a comprehensive view of the customer experience. It consolidates various customer interactions into a single, impactful metric, serving as a benchmark to directly compare your customer experience against that of competitors.

Let's pause here and reflect. Remember, building a data mindset is most effective when we focus on solving data-related problems. The section below is designed for exactly this kind of practice.

💡Food for thought: Imagine you're standing on the edge of an airplane, parachute strapped to your back, heart racing. You've been told that the chance of a successful skydive is incredibly high, yet the possibility of failure looms in the air. How do we navigate the fine line between what's probable and what's possible, especially when the stakes are sky-high?

Visualization Spotlight:

Net Promoter Score of Leading Life Insurance Brands in India in 2023

Human Bias Focus: Survivorship Bias

Did you know there are more than 180 ways your brain can trick you? These tricks, called cognitive biases, can negatively impact the way humans process information, think critically and perceive reality. They can even change how we see the world. In this section, we'll talk about one of these biases and show you how it pops up in everyday life.

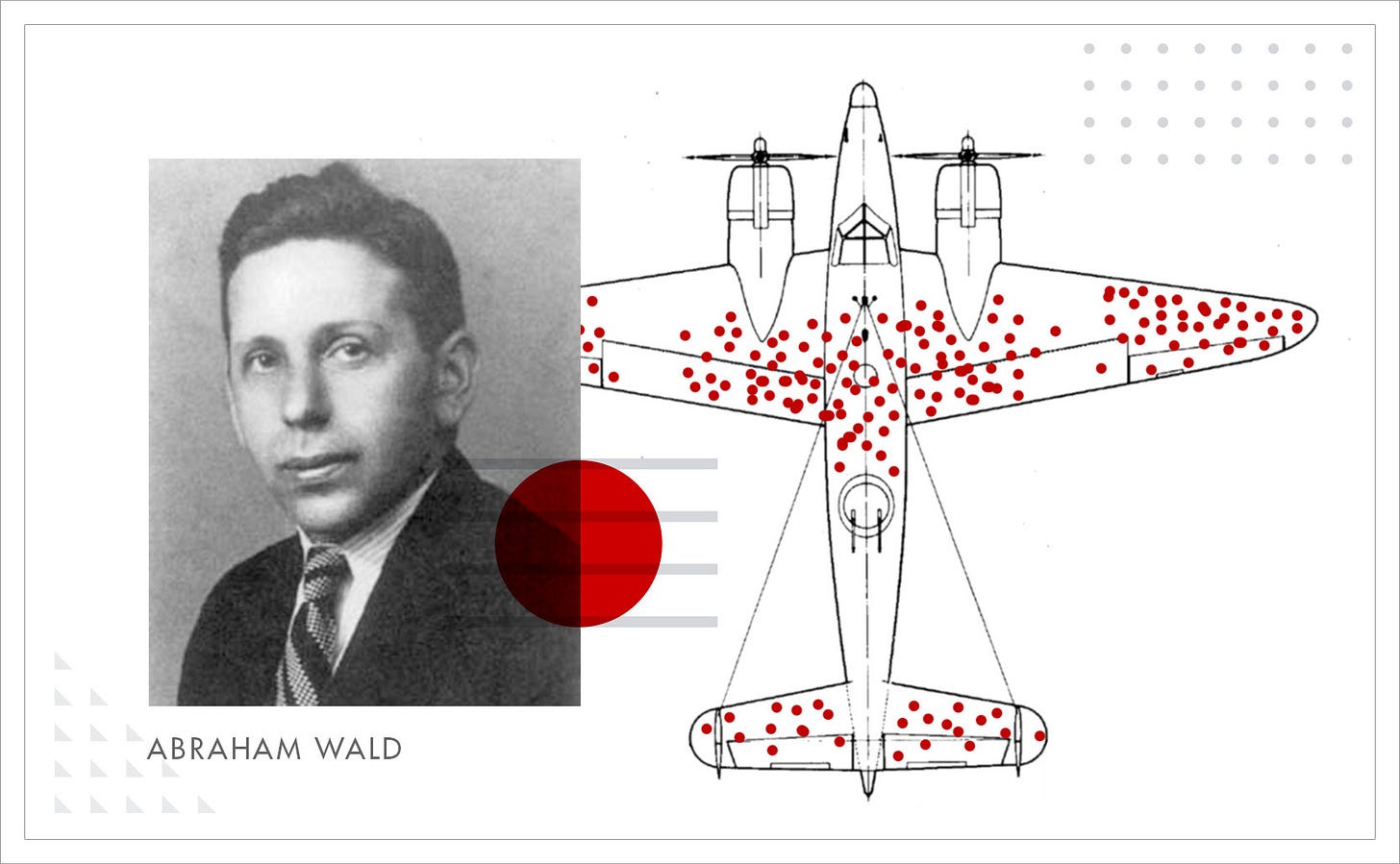

During World War II, a story emerged that became a foundational lesson in understanding data.

The military, examining the aircraft returning from battle, noticed a common pattern: significant damage to the wings, tail, and fuselage.

The initial solution seemed straightforward—reinforce these areas to enhance the planes' survivability.

However, Abraham Wald, a mathematician from Columbia University, introduced a pivotal shift in perspective. He observed that the military's analysis suffered from a critical oversight: it only considered the aircraft that survived.

Wald proposed a counterintuitive approach—reinforce the areas that appeared undamaged on returning planes, as these were likely the spots where hits could be fatal, evidenced by the absence of similar damage on planes that didn't make it back.

This narrative stands as a classic example of survivorship bias, a concept that reminds us of the disadvantage of drawing conclusions from incomplete data.

In data analytics, overlooking survivorship bias can lead to misleading interpretations and decisions. Take customer feedback, for instance: relying solely on input from repeating users might paint a better picture of a product, sidelining the valuable critiques and experiences of churned users.

Data Nuggets: Probability vs Possibility

In decision-making, understanding the interplay between probabilities and possibilities is crucial. Take skydiving, for example, the probability of a fatal accident is about 1 in 100,000 jumps, signaling a high likelihood of safety based on historical data. In contrast, the probability of getting killed in a road accident is significantly higher, roughly 1 in 107 in a given year in the U.S. This statistical comparison guides us toward seeing skydiving as a relatively safe activity, despite the perceived risk.

Yet, the realm of possibilities reminds us to factor in the full spectrum of outcomes, including those less likely. It emphasizes the importance of preparing for even the rarest events. While probabilities offer a base for rational decision-making grounded in data, possibilities encourage a broader view, ensuring we're not blindsided by the unforeseen. In essence, decision-making thrives on a balanced consideration of what's likely and what's possible, leveraging probabilities to inform our choices while remaining mindful of the less probable, yet possible, scenarios that could unfold. This balanced approach allows for more resilient and comprehensive planning, ensuring decisions are not just data-driven but also intuitively aligned with the wide range of potential outcomes.

That wraps up our newsletter for today! We've simplified intricate data concepts and will keep doing so in future editions. If you found this helpful, please consider subscribing and sharing it with someone who would love it—it motivates us to create more content.

References - Visualization Source, Quote Source, Image Source

I love stories that you cover! It keeps me hooked.